Activities

CHC’s Strategic Priorities

-

COMMERCIAL SALES & PARTICIPATION

Effectively manage the Marketing and Sales of the Republic of Cyprus’ share in hydrocarbons, in line with the Production Sharing Contracts (PSCs). Develop and maintain in house commercial capability. Assess and ensure readiness for commercial participation opportunities in midstream projects.

-

RESOURCE EVALUATION

Develop and maintain resource evaluations for prospects and discoveries within the Cyprus’ EEZ, in collaboration with MECI, to enable assessment of reservoir uncertainties and production potential.

-

FIELD DEVELOPMENT

Develop and maintain, evaluations of development concepts and monetisation routings for potential and commercial discoveries, including evaluation of technical feasibility, cost estimations and evaluation of appropriate technologies.

-

COLLABORATION

Support MECI in administration and monitoring of PSC’s, Licensing rounds and other regulatory activities. Where requested, work with government entities to continue the development of regulatory, organisational and commercial frameworks. Engage with PSC Licensees in consultation with MECI in evaluation of monetization options for commercial discoveries.

-

COMPETENCY

Continue to build the company’s reservoir of knowledge, experience and capabilities, so as to increase the breadth and level of competencies, as required to effectively manage the state’s direct and indirect commercial participation in hydrocarbon activities.

-

SUSTAINABILITY

Assess Energy Transition and Decarbonisation policies and initiatives and evaluate impact and implementation on Cyprus developments. Maintain a safe and effective working environment. Promote CHC’s culture of social and corporate responsibility, and commit to reflecting this culture outwards towards other stakeholders.

-

ENERGY CENTRE

In line with Government policy seek opportunities related to CHC activities which will support Cyprus in developing, over time, into a regional energy centre in East Mediterranean.

-

GREEN ECONOMY

CHC will support the Government’s Green Economy and National Climate and Energy Plan objectives and aspects of the energy transition and decarbonisation, investigating options such as offshore renewable energy potential and carbon geological storage potential.

The Delimitation of the Exclusive Economic Zone of the Republic of Cyprus

-

1988:

Cyprus ratified the United Nations Convention on the Law of the Sea (UNCLOS) which defines “the rights and responsibilities of states in their use of the world’s oceans, establishing guidelines for business, the environment and the management of marine natural resources and regulating the territorial waters, contiguous zones and exclusive economic zones (EEZ) of states”.

-

2003:

Delimitation Agreement of the exclusive economic zones (EEZ) with the Arab Republic of Egypt ratified in 2004.

-

2004:

Cyprus passed a Law defining and regulating its exclusive economic zones (EEZ). “Law to provide for the Proclamation of the Exclusive Economic Zone by the Republic of Cyprus” (the “EEZ Law”).

-

2007:

Delimitation Agreement of the exclusive economic zones (EEZ) with the Republic of Lebanon.

-

2010:

Delimitation Agreement of the exclusive economic zones (EEZ) with the State of Israel ratified in 2011.

-

2013:

Framework Agreement concerning the development of cross-median line hydrocarbon resources with the Arab Republic of Egypt.

-

2018:

Intergovernmental Agreement between Cyprus and Arab Republic of Egypt concerning a direct submarine natural gas pipeline.

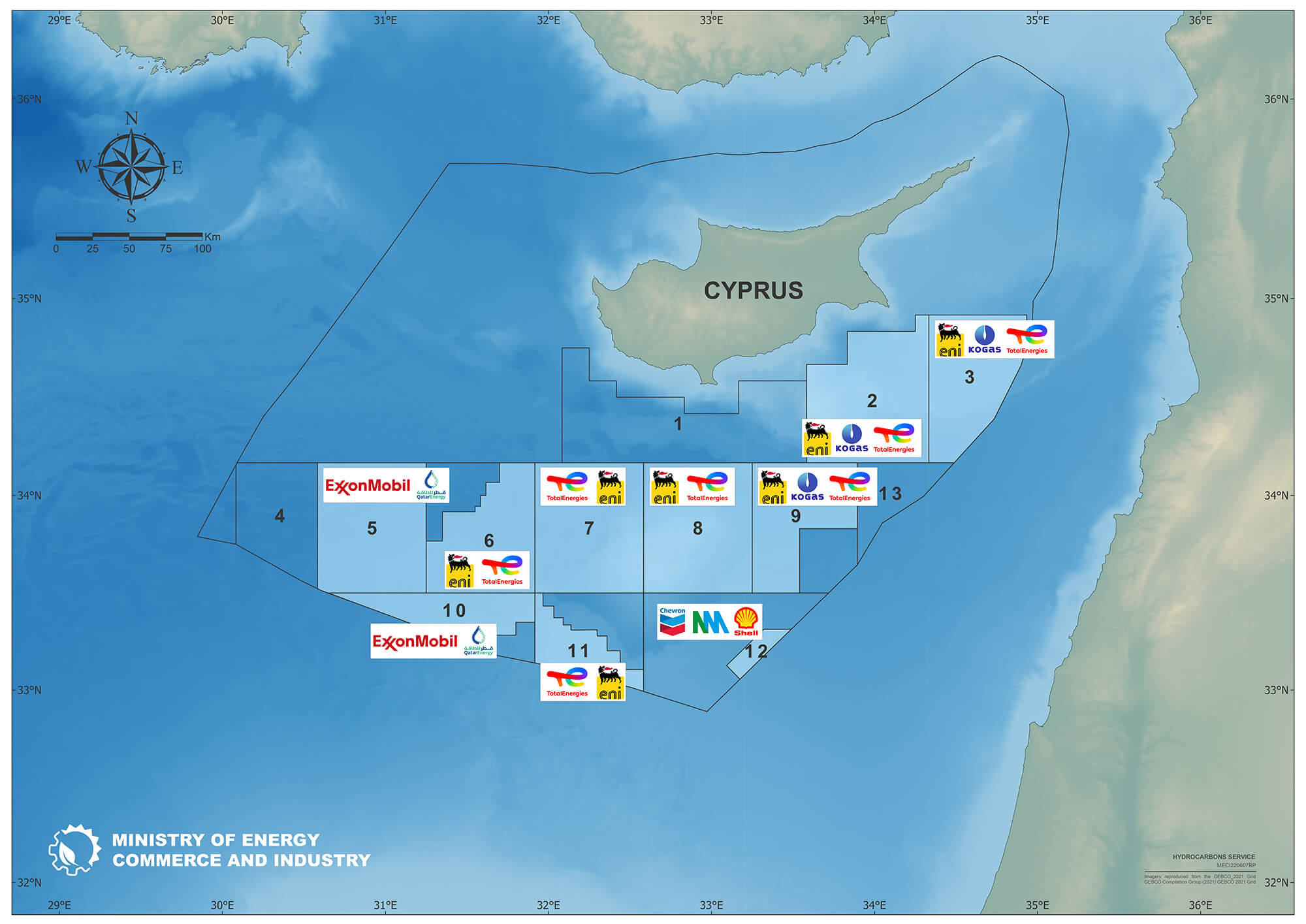

Hydrocarbon Activities in the Cypriot EEZ

Recent Oil & Gas activities in the Eastern Mediterranean have revealed the possibility of significant natural gas reserves in the area and also within Cyprus EEZ. Cyprus is in the process of fully exploiting its natural gas potential and contributing to regional and European cleaner energy sources and to energy security.

-

2007:

The Government of Cyprus proceeded with its first licensing round for eleven offshore blocks.

-

2008:

Awarded one Hydrocarbon Exploration License to Noble Energy International LTD for offshore block 12.

-

2011:

Exploration well drilled by Noble in Block 12 leads to the discovery of the Aphrodite field with contingent reserves estimated between 5-8 tcf (trillion cubic feet).

-

2011:

Delek joins the Block 12 License with 30% shareholding.

-

2012:

The Government of Cyprus proceeded with its second licensing round consisting of 12 offshore blocks.

-

2013:

Total awarded two Hydrocarbon Exploration Licenses for offshore blocks 10 and 11.

-

2013:

ENI / KOGAS awarded three Hydrocarbon Exploration Licenses for offshore blocks 2, 3 & 9.

-

2013:

Appraisal well drilled by Noble and Delek group on Aphrodite field confirms discovery of contingent reserves between 3.6 – 6 tcf.

-

2014:

Exploration well ‘Onasagoras’ drilled by ENI/KOGAS in Block 9 with non-commercial results.

-

2015:

Exploration well ‘Amathusa’ drilled by ENI/KOGAS in Block 9 with non-commercial results.

-

2015:

Block 12 Contractors confirm Aphrodite field commercial and submit Field Development Plan to the Minister of Energy.

-

2016:

BG Group (now part of Shell) joins the Block 12 License with a 35% shareholding.

-

2016:

The Government of Cyprus proceeds with its third licensing round consisting of 3 offshore blocks.

-

2017:

The Government of Cyprus awards licenses for all three blocks on offer in the 3rd licensing round; ENI International and Total in Block 6, ENI International for Block 8, and ExxonMobil and Qatar Petroleum for Block 10.

-

2017:

Exploration well ‘Onesiphoros’ drilled by Total in Block 11 with non-commercial results.

-

2018:

Exploration well drilled by ENI Block 6 leads to the discovery of the Calypso field, proving the extension of the Zohr-type carbonate play into the Cyprus EEZ.

-

2019:

Exploration well ‘Delphyne’ drilled by Exxon / QP in Block 10 with non-commercial results.

-

2019:

Exploration well drilled by Exxon / QP in Block 10 leads to the discovery of Glaucus field, with estimates of natural gas in-place of 5 to 8 tcf.

-

2019:

Exploration license for Block 7 awarded to Total/ENI with Total also farming into Blocks 2, 3, 8 and 9.

-

2019:

Minister of Energy approves Block 12 Aphrodite Field Development Plan and Government of Cyprus issued first Exploitation License to Block 12 Contractors.

-

2021:

Exploration license for Block 5 awarded to ExxonMobil/Qatar Petroleum.

-

2021:

Appraisal well ‘Glaucus-2’ drilled by ExxonMobil/Qatar Petroleum on the Glaucus gas field

-

2022:

Exploration well drilled by Eni/Total in Block 6 leads to the discovery of the Cronus field, with estimates of natural gas in-place of at least 2.5tcf.

Licensed Blocks

You can find more information regarding the activities of the licensed blocks, by clicking the corresponding block below.